The Collectivité introduces an ecotax on CO2 emissions

April 01, 2025The Collectivité de Saint-Martin is amending the General Tax Code to update existing provisions and reduce environmental pollution. Starting July 1, 2025, a tax on carbon dioxide (CO2) emissions will be levied upon vehicle registration.

Currently, the cost of vehicle registration is calculated solely based on the number of tax horsepower (horsepower). In accordance with the provisions of Article 1585 J of the Saint-Martin General Tax Code (CGIsm), the cost of the vehicle registration certificate is calculated using the following scale:

- €36/horsepower for vehicles less than 10 years old;

- €18/horsepower for vehicles over 10 years old.

For 2 or 3 wheels:

- Free for engine sizes below 125cc;

- 18€ for 125cc under 10 years old;

- €9 for 125cc over 10 years old;

- 36€/horsepower for cylinder capacities over 125cc.

This scale has never been modified since its introduction in 2015.

An update of these provisions is essential to meet a triple objective:

- Update the applied rate,

- Integrate an environmental dimension linked to the taxation of the COM,

- Participate in preserving the financial autonomy of the Collectivité.

From July 1, 2025, a tax on carbon dioxide (CO2) emissions will be levied when registering vehicles in the territory of the collectivité of Saint-Martin during any transfer or importation of a vehicle.

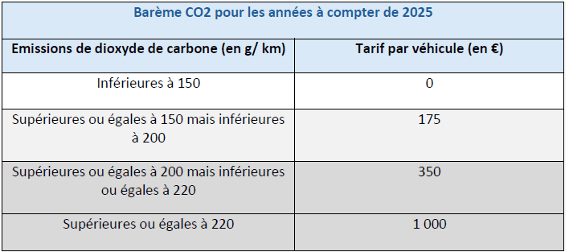

The amount of the tax is equal to a rate per vehicle determined based on carbon dioxide emissions using the scale for the year of registration of the vehicle.

The following are exempt, up to a limit of one vehicle per beneficiary:

1- Any vehicle adapted to accommodate a wheelchair;

2- Any vehicle owned by a person holding a "mobility inclusion" card bearing the "disability" note mentioned in Article L. 241-3 of the Social Action and Families Code; a military disability card.

This ecotax will allow the Collectivité to double the revenue from the tax on registration certificates over a full year, i.e. to increase from €0.95 million to €1.9 million.

Environmental taxation, which addresses major environmental issues, is intended as a tool to reduce pollution and environmental damage. Several environmental taxes have proven their effectiveness: in particular, taxes on fossil fuel consumption have helped reduce energy consumption in Europe and continue to explain why Europeans consume less energy than Americans, who face significantly lower energy taxes.

Ecotax scale

Ecotax scale